Natural Gas Trading

- Clay

- Mar 12, 2025

- 11 min read

Updated: May 12, 2025

Scroll to end for latest update on 5/12/2025 - 5:32am:

Belief is a funny thing...

You see,

If you believe you can - you're right!

And if you believe you can't - you're right!

But you can't cheat belief...

You can't just 'Profess it to Possess it'!

Belief must be 'Earned & Burned' into the subconscious.

Just as an athlete will train through grueling late night hours

while others are partying, playing, or sleeping,

the 'earned belief' will manifest when the game is on the line.

Just as in a game, trading demands the conviction of belief!

It demands swimming against the current...

"Buying when others are fearful,

And selling when others are greedy!" ~ Buffett

Take your time - watch, paper trade, or trade small amounts

until you have earned the belief in the trend,

as the trend is your friend.

Plan your trade,

Trade your plan...

Outside of processing distilled water into hydrogen (as shown in this video from Toyota), Natural Gas (ng) appears to be the perfect energy source for the present, near, and intermediate future… or beyond.

Ng is abundant, clean burning, easily accessed, a byproduct of oil production, and ready to burn. Engines burn cleaner with longer longevity while experiencing only a minor horsepower decline, and stores indefinitely… what’s not to like?

While easy production, abundance, clean burning, cost effective, and indefinite storage combine to make a great fuel source, the best part for us traders is that ng has a choke point - storage.

The supply is limited to the amount of storage facilities available, combined with the seasonality of demand, creates the trend price to reverse with the seasons. Barring existential events, such as pipeline disruption, geopolitical events, etc., ng price fluctuations follow temperatures - mild, hot, and cold… as repeatable as Winter, Spring, Summer, and Fall.

While worldwide ng demand accelerates, the underground storage facilities have failed to keep pace. Typically, ng storage facilities fill to capacity during the low demand shoulder months (Spring/Fall) - lowering prices. At this point the ng still being produced as a natural byproduct of oil drilling, either needs to be sold to a Liquid Natural Gas (LNG) facility where available, or simply burned off - wasted - until there is room in storage (warm or cool seasons).

So, from the peak winter heating demand, prices trend lower as supply increases into the shoulder months of Spring… then increase into the warm months of summer, as the majority of electricity is now generated with cost effective, clean burning, and abundant ng (known 100 years supply under The United States alone)... then decreases into the shoulder months of Fall… then drastically increases into the highest demand of Winter.

In 2024 the price fluctuation of ng was under $2 to over $4. That is a good percentage move on its own, but when combined by using 2x leveraged trading vehicles like BOIL (2x long ng) and KOLD (2x short ng), you can tap into a 200% price deviation 4 times a year… 200% - 4 times a year!

Stock trading is not for the faint of heart… buying when there is blood on the streets and selling into euphoria is not a natural human action - you have to plan your trade, and trade your plan - which is much easier said than done. Your advantage is that there are many retail traders in the market today. Retail traders are reactionary to current headlines, while seasoned traders are anticipatory of the coming headlines and sell on the news to the retail trader.

Point being… what can be more easily anticipated than mild temps in Spring/Fall, heat in the summer, and cold in the winter? Differences in each trader’s performance will be in their timing and execution, but the large percentage moves every 3 months provides a greater profitable margin of error than anything else I’ve encountered… even non-precise trades should generate nice percentage moves with each season should you choose to play both long and short. I believe the most risk is playing the short side, as more unexpected events could affect a rise in price than decline… with upwards of 200% seasonal moves, a slow cost-average approach should allow you to sell +25% or more Spring/Summer/Fall, and +50% in Winter.

While you could get much more fortunate than those numbers, I believe they are conservatively attainable… the best part is the 4 times annual compounding…

Position timing: There will be a time in late Winter when a forecast is for a warming trend across the country, anticipate, and be positioned ahead of that news. Your timing on that positioning (and your exit point) will obviously determine the total value of the trade... the great news is that there is so much seasonal movement on ng price, the timing in and out does not have to be as precise as most other trades to make a very nice profit... The end of each season will produce another great entry point, be it long or short.

Here are a few resources to help you get a knowledgeable jump on those entry/exit points:

One of the easiest, quickest, and free ways is the NOAA climate prediction website: Simply hover your cursor over the temperature for the various time frames from a 6-10 to a 3 month national outlook…

Nat Gas Weather is a subscription based website dedicated to forecasting ng price movement…

There is the EIA (U.S. Energy Information Administration) is another free website for energy forecasts…

Another site full of information and articles… NGI (Natural Gas Intelligence)

Here is a live streaming chart with ng news alerts...

As you can see there is plenty of info out there if you choose to get down into the weeds, but extensive day to day research is not as important with quarterly swing trading... one of the best things about being a quarterly swing trader is you are not tied to your computer all day… you can actually program your accumulative buys for the day, then hit the links if you want… accumulate to your target investment amount, hold 'til fundamentals shift, then sell - then repeat in the opposite direction for the next few months…

Based on the risk and volatility of the short/long and seasonal trends, I would suggest an approximate risk ratio of 50% of your allotted trading amount short into Spring/Fall, 75% long into Summer, and a full 100% investment from Fall into Winter… After surpassing those quarterly goals, I suggest putting on a stop loss as protection while you let your winner run…

Update 3/18/2025: NG bid higher pre-market at a pipeline was shut down for maintenance.

Prices have jumped .12 in 30 minutes... this is one of the unexpected events that can negatively impact when you are short ng prices... but it you have more buys available, it is a short-term buying opportunity... it will re-open... If short-term demand was high, they would not be doing 'scheduled maintenance.'

Update 3/23/2025: The long term growth demand is being anticipated by a large increase of storage capability of 33% over the next couple years... in theory, this limits upside price action until demand regains the upper hand... but long term trend is still for demand to outpace supply (storage)...

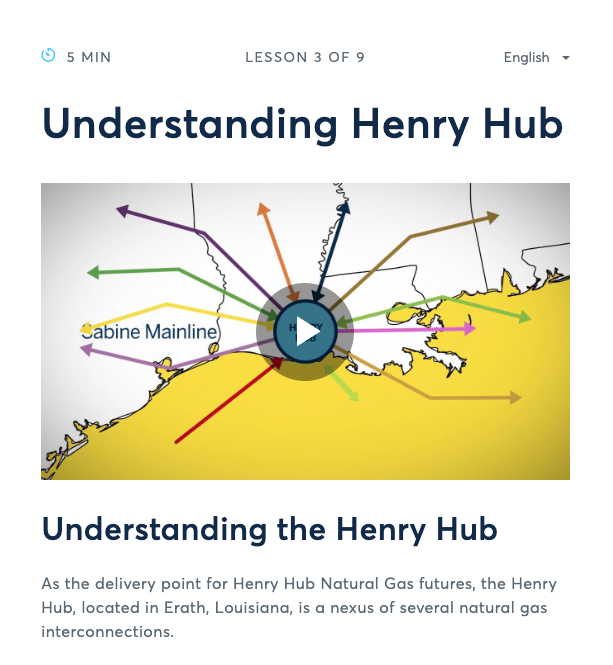

Update 3/24/2025: A video tutorial to understand Ng and how it flows:

Update 3/26/2025: Up 13% on the Spring KOLD trade, so a stop limit loss was placed just above the cost average price... A market maxim is to never let a winning trade turn negative. The percentage of movement allowed depends on the beta of the equity, in this case KOLD has a high beta (large % moves), I give it a 10+% buffer before setting stop limit protection... if it's triggered, but you think the trade is not done moving up, you can always buy it back at the same or near price with upward momentum. With Ng you will probably want to instead look at the possibility of building a new position on a trend reversal for the coming season.

Update 3/26/2025: In this chart you can see how Hg prices have been range bound, but is starting to break to the downside. Albeit starting at lower than historical averages, 2025 is only the 2nd time in history that there has been a March build in storage, which normally doesn't start until sometime in April. With warmer than normal National weather predicted for the next few months, barring unexpected supply shocks, this should bode for quite a price drop lower through April.

Update 4/2/2025:

Right on schedule... the Spring KOLD season officially opened 4/1/2025 with a nice 8.9% pop...

While it is never going to be linear (high volatility in Ng, and compounded with BOIL & KOLD) the trend is for lower Ng prices for the next 6-8 weeks. Shorting will always be riskier, but milder weather should allow for a build in Ng supplies until the AC demand hits during summer...

Update 4/6/2025:

Whew... what a few days this has been... Tariff day turned out to be Tug-of-war time for Na... So, while the weather was predicting unseasonably warm weather for most of the nation, the overall market risk-off sentiment created a flight to safety (utilities, commodities, energy, staples, etc.). This put a bid under Na prices for a couple days... finally broke down to create a nice pop for KOLD...

Update 4/18/2025:

Technicals: Here is a 2 year daily for /NG showing the recent support breakdown through $3.50, $3.45, and currently bouncing around the $3.21 level, with next support around $3.15, $3.13 and then could have a woosh to $3.00, where the Bulls will do their best to defend.

$3.00 looks to be a multi-year mean and merges with the 200 day moving average. Unless price falls straight through $3.00, this is where I will look hard at taking profits, then analyzing with a clean slate. (Watch for a bounce and retest.)

Odds are, this early into the injection season with the warm national forecasts, there should still be downside juice left to squeeze if the 200dma/$3.00 is violated.

The highest volume shelf is around $2.70 providing another exit/evaluation point.

If $2.70 is violated, well, we will discuss if/when that happens...

Update 4/20/2025:

The current probabilities and estimates of the annual supply/demand for Ng is bullish, but (outside of temporary shocks) the price increase is incremental.

The quarterly trends have been discussed.

The EIA Natural Gas Report is released each Thursday at 7:30am pacific and tallies the weekly storage injection or withdrawal amounts. When the report hits the newswires (just like with most stocks) the knee jerk price movement is usually the wrong direction - as traders quickly try to limit their downside. There will be a huge volume spike with volatility creating an excellent entry/exit point. The wrong price move direction will only last a few minutes, so you need to be ready to strike!

The daily volatility when using BOIL or KOLD as your trading vehicles will test your resolve. A 3-5% daily move will be calm to normal, 8-10% will happen often enough to take advantage as a buy or sell signal, with occasional 12-18% moves, and have been privy to a 28% daily move... Better fill up that belief tank. ;-)

Update 4/21/2025:

Ng reached a very interesting technical juncture today...

It bounced off the 200 dma exactly at $3.058, but did not show enough volume to look sustainable, so I kept my KOLD position. It retested, then broke down through the 200 dma, and is trying to get back above in the lower volume after hours. It needs to verify that breakdown over the next few days.

Ng ever so briefly fell through the $3.00 strong support level, then had a large volume spike that kept it between the $3 support and the $3.058 dma the rest of the day.

Both the 200 dma and the support should be tested tomorrow or soon, as the sharp downtrend is still in tact, and the warmer weather is still creating downward price pressure...

If the Bulls can't hold the $3 line in the sand, The next volume shelf for support is around the $2.68 area. Given it's still early in the injection season, if the Bulls can't hold the line right here, there very easily could be a violent capitulation on heavy volume to the downside! 😎

Update 4/22/2025:

Update 4/24/2025:

The EIA weekly Ng storage report came in with a higher than expected build...

The increased supply, coupled with the warmer weather forecast, the tariff uncertainty on the world economy, trading below the 200 dma, below the $3.00 psychological support level, and still below the recent trend line, it's logical to assume that Ng is headed for the next volume shelf of around $2.68...

Update 4/25/25 - 5:16am:

Technicals... While all the fundamentals are still bearish for short term Ng prices, the rate of decent (trend line - 3 upper arrows) has been extremely steep. This has resulted in an oversold RSI of 27 (relative strength index - 3 lower arrows). This does not mean the decent will reverse, but it does make it likely to pause, slow, or trend sideways until the RSI rises above the 30 oversold mark... 😎

Update 4/28/2025 - 4:55am:

Update 4/30/2025 6:28am:

The rolling from the May to June futures created an opportunity for the Bulls to attack as Ng was also at an oversold 27 rsi (only the 2nd such reading in the last year.)

With stop losses set, I was stopped out on KOLD (short NG price) twice... both times I repositioned with even more shares from the profits, because nothing has changed fundamentally... the weather forecast mild, production still happening, injections increasing...

While I can always be wrong, and wouldn't blame anyone for taking profits while waiting for an entry into the summer long position.... the point is that if you are not ready to enter a long summer position, then short is still the side to play.

When to flip will determine the differences in individual gains or losses, but taking a +50% quarterly gain is a great profit, when compounded, will make you very wealthy in just a few years! I feel there is a bit more weakness to Ng price based on technical oversold easing and near-term (2+ weeks) fundamentals... 😎

Update 5/5/2025 6:30am:

This in an excerpt from NGI:

Bottom line - technicals short-term bullish and fundamentals medium term bearish...

Personal feeling is that there should be a near-term pull back in Ng price before a bump up over the summer cooling season.

Update 5/7/2025 6:55am:

Time to start looking at a short Ng exit level and entering a long position for the summer cooling season...

If the downtrend pauses around the $3.33 support, I will probably exit.

For sure out of the short before the end of the month when we roll over to the July futures contract, and hopefully, a good long position established.

Update 5/8/2025 5:50am:

The early summer Bulls are creating aggressive price volatility, especially in the overnight trading when volume is very light. This morning's injection report (each Thursday at 7:30am Pacific) will likely have more volatility around the announcement than normal... It should be a triple digit build, but if not, the bulls will be charging, and may trigger a price stop.

Update 5/8/2025 8:05am:

The Ng storage build was triple digits which created a knee-jerk price reduction, but the build was less than last month; therefore, I decided to cover the short position, and now look for opportunities to go long for the summer bump... 😎

Update 5/12/2025 5:32am:

Below are the current monthly Ng futures prices for the next year. The current $3.78 Ng June price seems to be a little too bullish - a little too early. While I don't want to short Ng into an upward summer trend, I am looking for a pullback before getting all bulled up...

The candlestick chart shows a good entry zone between $3.33 and $3.50... When levered with BOIL or options, that entry area should give you a decent opportunity to make a +30% profit over the next couple months.

"Believe the Invisible,

Do the Uncomfortable,

And You will Achieve the Impossible!"

*** Disclaimer: Hey, I'm an amateur trader doin' my own thing. If you can combine some of this information with yours to benefit - great, but you should always conduct your own due diligence without relying entirely on anyone... Good Luck! 😎

Comments